Costa Rica Home Buying on a Budget: Learn How With Gap Equity Loans

Starting your affordable home buying journey in Costa Rica can feel overwhelming if you’re on a tight budget. The experienced team at Gap Real Estate is here to help. With more than 20 years of experience, they offer solid support and advice. They aim to make your dream home in Costa Rica a reality, focusing on budget-friendly investments.

The experts at Gap Real Estate have a wide portfolio and deep understanding of local trends. They match your home dreams with what’s financially possible today. To begin your path to affordable home ownership in Costa Rica, get in touch via www.gaprealestate.com, WhatsApp at +506 4001-6413, or email at [email protected]. They’re dedicated to making your real estate quest successful and lasting.

Key Takeaways

- Trust in the 20 years of local real estate expertise that Gap Real Estate brings to your property search in Costa Rica.

- Discover budget-friendly real estate options tailored to meet your financial boundaries.

- Leverage strategic financial planning to make home buying in Costa Rica both affordable and efficient.

- Connect with reputable professionals to assist in every step of your home buying process and secure the best possible deals.

- Familiarize yourself with the market conditions, financing options, and necessary documentation for a smooth transaction.

- Consider the advantages of alternative financing methods offered by firms like GAP Equity Loans for your property purchase.

- Maximize your investment in Costa Rica’s stable economy and burgeoning tourism industry, all while adhering to your budget.

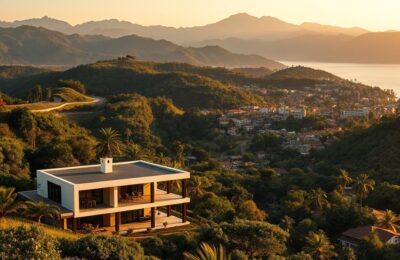

Unveiling the Affordable Real Estate Paradigm in Costa Rica

In affordable real estate Costa Rica shines as a top choice for value seekers. Gap Real Estate has 20 years of experience, helping clients find the right property. We aim to help you find a home that fits your budget and lifestyle perfectly.

Gap Real Estate’s 20 Years of Expertise

Two decades show our deep understanding and connections in Costa Rica. We know the ins and outs of cost-efficient home buying strategies Costa Rica. We introduce you to special deals and listings you won’t find anywhere else.

Identifying Budget-Friendly Housing Options in Costa Rica

Finding a budget-friendly house acquisition Costa Rica can be straightforward with us. We look for properties that offer both affordability and quality. Whether it’s a home near Pérez Zeledón or a beachfront villa, we guide you through the diverse market.

Imagine owning a piece of paradise at Kinkara. This place combines natural beauty with sustainable living. It showcases how you can live affordably and eco-friendly in Costa Rica. Kinkara’s values match ours, focusing on community and eco-friendly living.

In this golden real estate era, don’t let money worries stop you. Explore affordable Costa Rican real estate with us. Reach out via WhatsApp (+506 4001-6413) or email ([email protected]). Let’s find your dream property together.

Crucial Steps for a Cost-Effective House Purchase in Costa Rica

For over 20 years, Gap Real Estate has helped people buy homes in Costa Rica without stress. We make sure that finding a budget-friendly home in Costa Rica is easy and clear. Knowing how to plan your finances for buying a home here is key. It ensures you get the best property without risking your financial future. We’ll show you some important things to consider to see if you’re ready and can afford it.

Understanding Your Financing Options

Learning about your financing options is vital when you want to buy a house in Costa Rica without spending all your money. Being ready means knowing your budget well and getting pre-qualified by a lender. Otherwise, you might not be ready to buy. A big down payment is usually needed. At least 20% of the home’s price is standard. But, remember to plan for other costs like bank fees, movers, and house insurance.

Navigating the Housing Market with Professional Assistance

Using a professional agency like Gap Real Estate can make buying a home in Costa Rica easier. You should know that real estate agent fees are about 5% of the sales price, plus a 13% VAT tax. Sometimes, these fees can be as high as 10% in areas that are not as popular. Also, keep in mind taxes, notary fees, and costs like due diligence and escrow services. These can add up to nearly 3%. After buying, expect to wait 10-15 days for the title to transfer.

With our help, you can avoid extra costs and problems. This makes buying your dream home possible. For more info, contact us on WhatsApp at +506 4001-6413 or email at [email protected]. Let’s find your dream home in Costa Rica together.

Owner Financing in Costa Rica: A Route to Affordable Homeownership

The property market in Costa Rica has seen big price increases. This is especially true since the pandemic caused more people to buy. Because of this, looking into different ways to finance a home is key. Owner financing is one of those ways, helping buyers navigate the tricky real estate market.

Benefits and Risks of Owner Financing

Owner financing in Costa Rica has lots of pros, especially for those who can’t get bank loans right away. It offers more flexible terms, possibly lower initial payments, and faster deals. It also opens the door for people with less money or those new to the area to buy a home.

But, there are downsides to owner financing in Costa Rica too. You might pay more interest than with a bank loan. Plus, buyers must be very careful to make a safe deal. It’s smart to work with someone you trust to avoid these risks.

Negotiating Favorable Terms with Sellers

Negotiating with sellers means knowing a lot about the market and the home you like. It’s important to grasp how owner financing works, from the down payment to repayment. This will help get a deal that’s good for everyone.

There are many ways to finance a home, like using home equity loans or IRAs. Still, many find owner financing the best choice. It offers flexible payback terms that standard loans usually don’t.

If you’re thinking about buying real estate in Costa Rica with owner financing, be thorough. Do your homework and talk with experts. Whether it’s a beach house or a city home, being informed will help. Buying a home is not just an investment. It’s about making a dream part of your life, safely and for the long term.

Bank vs. Private Financing: What’s Best for Your Costa Rican Dream Home?

When you’re looking to buy your dream home in Costa Rica, knowing the difference between bank financing Costa Rica and private financing Costa Rica is key. This is especially true if you’re buying property on a budget. Our team’s experience along the coast has taught us a lot about these options. We are here to help you choose wisely.

Normally, banks have mortgages with fixed or adjustable rates. But getting a loan from a Costa Rican bank means facing high fees and a long wait. For foreigners, it’s even tougher due to strict rules and extra costs. These can add up to 3% of the loan value, which is more than the usual closing costs.

On the other hand, GAP Equity Loans offers private financing Costa Rica with quicker processes. While the interest might be higher, it’s easier to start repaying. This route is beneficial if you want to quickly own a home. Lately, many deals have been made with seller financing, showing that buyers prefer flexible terms.

Costa Rica’s strong rental market is also worth considering. It offers homeowners a way to cover their expenses via vacation rentals. This adds financial stability to owning property, which is critical for those buying property on a budget.

| Financing Type | Interest Rates | Approval Process | Additional Costs | Foreigner Accessibility |

|---|---|---|---|---|

| Bank Financing | Lower than private | Lengthy | 3-5% higher fees + 3% closing costs | Difficult (requires residency) |

| Private Financing | Higher than banks | Quick | Varied, often lower than banks | More accessible |

Few people manage to get bank financing Costa Rica. The banks’ cautious approach means they rarely fail but can be daunting for non-residents. This makes it hard for many to invest in property here.

GAP Equity Loans and other private financiers offer an easier and quicker way to finance homes. The tax benefits and chances to leverage investments make buying here appealing. Since the market is always changing, waiting too long could mean missing out on great deals.

If you need help with financing for a home in Costa Rica, contact us. Our knowledge is your advantage in finding the right financing path. We aim to help you realize your dream of owning a home in the tropics.

Smart Real Estate Investments in Costa Rica: Strategies for the Budget Conscious Buyer

Costa Rica offers a wealth of smart real estate investments for those on a budget. Whether for personal use or rental income, there are lucrative chances. Gap Real Estate gives you market insights and strategies for wise decisions.

Exploring Low-Cost Real Estate Options

Looking for low-cost real estate options in Costa Rica means watching for future value. We help spot emerging areas with growth potential. Renovation-ready properties are a way in at a lower cost, with room for value growth through updates.

Strategic Financial Planning for Home Buying

We stress strategic financial planning for affordable ways to buy property. Custom financial plans boost your smart real estate investments in Costa Rica. Pairing with Gap Equity Loans offers flexible financing tailored to your investment goals.

| Year | FDI in Costa Rica (USD) | GDP Percentage | Significant Economic Event |

|---|---|---|---|

| 2000 | 409 Million | N/A | Baseline Year |

| 2008 | Over 2 Billion | N/A | CAFTA-DR Agreement Effect |

| 2013 | Over 2.6 Billion | 5.4% | Peak Foreign Investment |

| 2015 | 2.1 Billion | Decline | Acession Talks with OECD |

| Note: Data reflects Costa Rica’s economic climate and pivotal moments influencing investment decisions. | |||

How to buy a house in Costa Rica without using all of your money

Looking to buy property in Costa Rica without breaking the bank? It’s key to know all the ways you can finance. With a $150,000 minimum for getting residency and a low property tax of 0.25%, it’s smart money-wise. Using escrow for your payments in real estate deals keeps your money safe.

Expat communities in Costa Rica are more than neighbors—they often become like family. This close-knit atmosphere makes living enjoyable and boosts your property’s value due to its stability and attractiveness. Many buyers get expert advice to make sure they’re making good choices, showing how vital it is to know what you’re doing.

Thinking about making some money from your property by renting it out? Many properties in Costa Rica are perfect for this, helping to lower what you spent. It’s also smart to consider the real estate tax situation for planning your finances. Getting help from a pro can make checking everything out a lot easier.

With 20 years of doing this, we at Gap Real Estate stress how crucial being informed and transparent is. Learn about buying property in Costa Rica on a budget, with expert advice guiding you from dreams to owning your own place.

Finally, figuring out how to finance a property in Costa Rica is quite the journey. By using these tips, you can understand the market better and find affordable options. Our team is eager to help you join those who’ve made smart investments in Costa Rican real estate.

Payment Options and Loan Structures: Finding What Works for You

Exploring Costa Rica’s real estate means knowing your payment options and loan structures. This is crucial for international clients. Our expertise at Gap Real Estate can make these financial decisions easier for you.

Comparing Cash, Bank Financing, and Private Financing

How you pay can influence the outcome of buying property internationally. Cash-in-Advance, using wire transfers or credit cards, brings certainty to buyers. It also gives you power in negotiations and avoids mortgage problems. However, not all investors prefer or can use cash.

Bank Financing and Letters of Credit (LCs) offer secure transactions but can be complex. Documentary Collections (D/Cs) are simpler and cheaper than LCs but have less security against non-payment. Each option balances cost against security.

Private loans, like those from Gap Equity Loans, are becoming popular. They’re quick to get, flexible, and you can use your assets as backup. This path is appealing for its efficiency and market entry benefits.

Key Considerations for International Buyers

Buying in Costa Rica comes with its complexities. Open Account transactions favor importers by delaying payment but pose risks to exporters. Consignment gives buyers flexibly, holding off on payments until the property is sold.

Taxes also impact these decisions in Costa Rica. Deed and mortgage taxes add to the costs for international buyers. Consider how withholding taxes and interest deductions affect your investment.

It’s essential to understand Costa Rica’s tax system, which only taxes local income. This affects how much you’ll pay for a property overall. We at Gap Real Estate can help you navigate these financial aspects. We aim to make your investment in Costa Rica successful, using our twenty years of experience.

Conclusion

Finding affordable housing in Costa Rica means you don’t have to spend all your money. With careful planning and good advice, finding your dream property is easier than you think. At Gap Real Estate, our 20 years of experience help us guide you smoothly through buying a home. We prove every day that owning a home in Costa Rica can be affordable.

Call Today To Discuss Your Loan Options

The real estate market in Costa Rica is complex but understanding it can be simple. Whether you pay in cash, use owner financing, or get a loan through Gap Equity Loans, we protect and grow your money. We make sure buying a home in Costa Rica is straightforward, especially for international investors.

We’re here to help with your real estate needs in Costa Rica. We offer many loan options to boost your buying power. Our goal is to make your dream of owning a home in this paradise a reality. Contact us through WhatsApp at +506 4001-6413, email at [email protected], or visit our website. Let’s find your dream home in Costa Rica together.

FAQ

What are some strategies for affordable home buying in Costa Rica?

How can Gap Real Estate assist with finding affordable real estate in Costa Rica?

What financing options are available for buying a house in Costa Rica?

What should I know about owner financing in Costa Rica?

What are the differences between bank financing and private financing for purchasing a home in Costa Rica?

How can I make smart real estate investments in Costa Rica on a budget?

What are some tips for purchasing property in Costa Rica on a budget?

How should international buyers approach payment options and loan structures when buying property in Costa Rica?

Source Links

- https://crie.cr/financing-a-property-in-costa-rica/

- https://crie.cr/mortgages-in-costa-rica/

- https://www.7×7.com/kinkara-costa-rica-eco-resort-2645043330.html

- https://www.normschriever.com/blog/archives/06-2014

- https://ticotimes.net/2022/02/03/8-signs-you-are-not-ready-to-buy-a-house-in-costa-rica

- https://news.co.cr/a-full-legal-cost-breakdown-and-guide-to-buying-a-home-or-property-in-costa-rica/82859/

- https://wise.com/us/blog/buy-property-in-costa-rica

- https://bluewaterpropertiesofcostarica.com/blog/costa-rica-real-estate-financing-4-options/

- https://remax-ocr.com/dont-buy-in-costa-rica-without-this-basic-knowledge/

- https://www.costaricadiscovered.com/real-estate-financing-costa-rica

- https://2009-2017.state.gov/e/eb/rls/othr/ics/2015/241525.htm

- https://www.hacienda.go.cr/docs/RepublicOfCostaRicaOfferingCircularMarzo2023.PDF

- https://www.hacienda.go.cr/docs/CostaRicaNov2023OC.PDF

- https://tamarindopark.com/news/buying-a-home-in-costa-rica-here-is-all-you-need-to-know

- https://www.trade.gov/methods-payment

- https://www.dentons.com/en/services-and-solutions/global-tax-guide-to-doing-business-in/costa-rica

- https://www.twoweeksincostarica.com/buying-house-costa-rica/

- https://www.propertiesincostarica.com/articles/purchasing_property.htm

- https://www.coastalrealtycostarica.com/the-gold-coast-blog/can-americans-buy-property-in-costa-rica